Ethereum Price Prediction: Institutional Accumulation vs. Technical Resistance at $4,475

#ETH

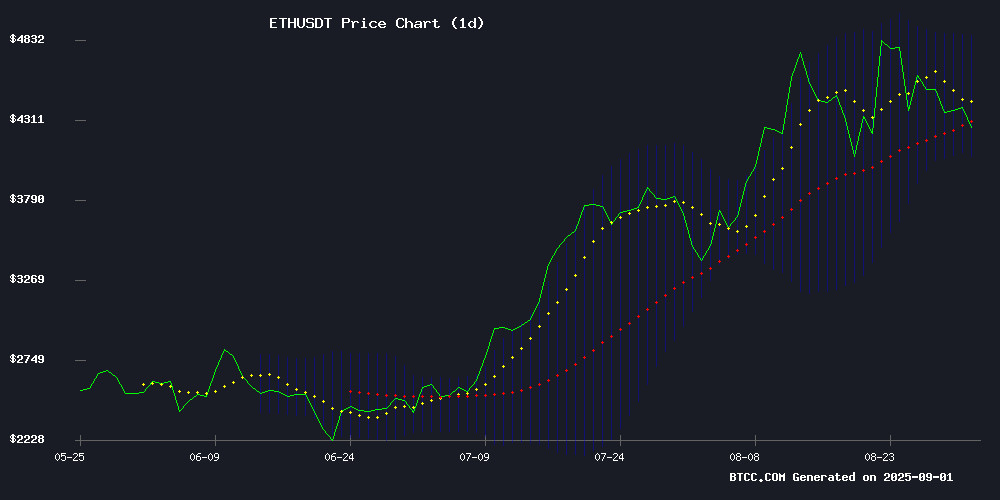

- ETH trading below 20-day MA at $4,475 suggests near-term resistance but improving MACD momentum indicates potential reversal

- Institutional accumulation reaching 9.2% of supply provides strong fundamental support despite recent ETF outflows

- Bollinger Band range between $4,093-$4,856 defines near-term trading parameters with breakout potential above $4,475

ETH Price Prediction

Technical Analysis: ETH Shows Consolidation Signals Below Key Moving Average

ETH is currently trading at $4,410.87, sitting below its 20-day moving average of $4,475.10, indicating near-term bearish pressure. The MACD reading of -14.91 versus -114.11 signal line shows improving momentum despite remaining in negative territory. Bollinger Bands position the price between $4,093.81 and $4,856.38, suggesting consolidation within this range. According to BTCC financial analyst James, 'The current technical setup suggests ETH is testing support levels while building momentum for a potential breakout above the 20-day MA.'

Market Sentiment: Institutional Demand Clashes with Profit-Taking Pressure

Ethereum faces mixed signals as institutional demand reaches record levels while whales exit positions, creating volatility concerns. The market shows strong fundamental support with institutions and ETFs now holding 9.2% of ETH supply and whales accumulating $358 million during recent volatility. However, US ethereum ETFs experienced $165 million outflows after six days of inflows, indicating profit-taking behavior. BTCC financial analyst James notes, 'The institutional embrace of Ethereum as a "Wall Street token" for stablecoin infrastructure provides long-term bullish fundamentals, though short-term volatility from whale movements and ETF flows may create temporary pressure.'

Factors Influencing ETH's Price

Ethereum's Institutional Demand Outpaces Market Expectations Amid Record Highs

Ethereum's proximity to all-time highs hasn't deterred institutional accumulation, with treasury firms and spot ETFs absorbing nearly 5% of circulating supply since June, according to Standard Chartered's Geoffrey Kendrick. The aggressive buying momentum propelled ETH to $4,955 on August 24 before a modest correction.

Structural demand is being driven by entities like BitMine Immersion, which alone targets 5% of ETH's total supply. Kendrick suggests the current accumulation phase presents a strategic entry point for long-term investors, despite elevated prices. Retail traders, meanwhile, are pivoting to newer tokens like MAGACOIN FINANCE for higher-growth opportunities.

ETH treasuries trade at a discount to Bitcoin-focused counterparts, with SharpLink Gaming and BitMine Immersion both below MicroStrategy's NAV multiple. An added advantage: Ethereum's staking yield of ~3% creates a yield advantage absent in Bitcoin strategies. SharpLink's share buyback commitment further establishes a price floor for investors.

Ethereum Whales Exit as Spot Activity Heats Up, Raising Volatility Concerns

Ethereum's market faces mounting pressure as large holders offloaded $1.8 billion worth of ETH over two weeks. The exodus of 430,000 ETH from whale wallets marks the lowest balance levels in weeks, testing market resilience during a period of thinning liquidity.

Spot trading activity has entered a volatile "heating" phase according to CryptoQuant's metrics, with concentrated exchange flows suggesting intensified battles between buyers and sellers. While retail investors provide some cushion against steeper declines, the 90-day Spot Taker CVD reveals persistent sell-side dominance.

The market now watches whether heated spot activity signals accumulation or further distribution. Recent liquidations claimed $23 million from short positions, adding fuel to Ethereum's unpredictable price action.

US Ethereum ETFs See First Outflow in Six Days as $165 Million Exits Market

BlackRock's iShares ethereum ETF had been a standout performer among 4,400 tracked funds, ranking second in inflows just days before the reversal. The $164.64 million net withdrawal on Friday snapped a six-day accumulation streak that had seen $1.08 billion enter the products.

Grayscale's ETH mini-trust bore the brunt with $61.3 million exiting, while Fidelity's FETH shed $51.02 million. The outflows extended across providers - Grayscale's ETHE lost $28.64 million and Bitwise's ETHW saw $23.68 million depart, signaling broad-based profit-taking after the sector's recent rally.

Ethereum Community Foundation Introduces BETH Token to Visualize ETH Burns

The Ethereum Community Foundation (ECF) has launched BETH, a new token designed to make Ethereum's burn mechanism tangible. This initiative reinforces ETH's position as Ethereum's core asset while addressing ongoing debates about scarcity in the network's monetary design.

BETH operates through a smart contract that burns ETH and issues an equivalent amount of the new token. Unlike the abstract fee burns implemented through EIP-1559, BETH provides a visible representation that can circulate within decentralized applications. The foundation positions this as a foundational element for proof-of-burn systems, potentially enabling burn-based governance and novel coordination mechanisms.

"BETH highlights the role of scarcity and destruction as equally powerful forces alongside creation and issuance," the ECF stated. Core developer Zak Cole compared its function to wrapped Ether (WETH), suggesting it could standardize burn tracking across protocols.

Ethereum Faces Potential Volatility in September Amid Profit-Taking Signals

Ethereum enters September with mixed signals as historical data suggests subdued performance during this month. The cryptocurrency posted modest gains of 3.20% in 2024 and 1.49% in 2023, following a streak of negative Septembers in prior years. Market indicators now point to potential choppiness ahead.

Net Unrealized Profit/Loss (NUPL) metrics reveal Ethereum's long-term holders are sitting on significant gains, with the current reading of 0.62 approaching three-month highs. Past instances of similar NUPL levels have preceded corrections—notably the 8.9% drop on August 17 when NUPL hit 0.63, followed by another 9.3% decline later that month at 0.66.

Despite near-term headwinds, fundamental support for Ethereum remains robust. RAAC CEO Kevin Rusher notes the persistent demand from corporations accumulating ETH continues to underpin the asset's long-term value proposition. The tension between profit-taking pressures and institutional adoption sets the stage for a potentially volatile September.

Ethereum Touted as 'Biggest Macro Trade' with $12K Price Target by Strategist Tom Lee

Fundstrat's Tom Lee projects Ethereum could surge to $5,500 near-term and $12,000 by year-end, citing stablecoin adoption, institutional blockchain adoption (Project Crypto), and AI integration as key catalysts. The strategist positions ETH as the foundational LAYER for both global finance and artificial intelligence infrastructure.

Despite a 12% price correction, institutional demand appears robust. U.S. spot ETH ETFs have absorbed nearly $10 billion in inflows over two months, while corporate treasuries now hold 3.7% of circulating supply—approximately $19 billion worth at current valuations.

Lee's bullish case hinges on Ethereum's role in verifying AI-generated data through zero-knowledge proofs. 'Agentic AI and robots will require Immutable verification systems,' he noted during a recent X Spaces interview, framing ETH as the prime beneficiary of converging technological trends.

Ethereum Exchange Reserves Decline Signals Accumulation Amid Price Volatility

Ethereum's recent price drop below $4,600 has sparked market anxiety, but on-chain data reveals a contrasting narrative. Binance's ETH reserves plummeted 10% in under a week—from 5 million to 4.5 million tokens—as investors moved holdings off exchanges. Such outflows typically signal accumulation, with whales positioning for long-term gains despite short-term bearish sentiment.

Analyst Darkfost highlights this divergence between price action and fundamentals. While retail traders react to volatility, institutional players appear to be quietly building positions through private wallets and DeFi protocols. Ethereum's underlying demand remains robust, setting the stage for a potential rebound when market sentiment stabilizes.

ARK Invest Expands Crypto Holdings with $15.6M BitMine Purchase Amid Ethereum Focus

Cathie Wood's ARK Invest bolstered its cryptocurrency portfolio with a $15.6 million acquisition of BitMine Immersion Technologies (BMNR) shares, signaling continued confidence in Ethereum-centric strategies. The purchase occurred despite BMNR's 7.85% price decline on August 27, with allocations spread across three ARK ETFs: Innovation ($10.48M), Next Generation Internet ($3.27M), and Fintech Innovation ($1.87M).

The MOVE extends ARK's summer spending spree on BitMine beyond $200 million, coinciding with portfolio rebalancing that saw reductions in Coinbase ($90.5M) and Roblox ($57.7M) positions. Market observers interpret the sustained accumulation as an endorsement of BitMine's Ethereum infrastructure play, even as Wood's firm diversifies across tech sectors with concurrent investments in AMD, DoorDash, and Airbnb.

Ethereum Dubbed ‘Wall Street Token’ as Financial Institutions Embrace Stablecoin Infrastructure

Jan van Eck, CEO of VanEck, has branded Ethereum as "the Wall Street token" amid its recent market surge. The characterization comes as traditional financial institutions scramble to adapt to growing stablecoin demands.

"Every bank and financial services company now needs infrastructure to process stablecoins," van Eck stated during a Fox Business interview. Transactional infrastructure will determine the winners in this evolving landscape, with Ethereum's EVM methodology positioned as the likely foundation.

The GENIUS Act's July passage marks a watershed moment for stablecoin regulation. As the first federal framework governing digital assets, it accelerates institutional adoption timelines while clarifying compliance pathways.

Whales Accumulate $358M in Ethereum Amid Market Volatility

Ethereum's price swings have not deterred institutional investors and large holders from aggressively accumulating the asset. Fresh data reveals 78,891 ETH ($358M) moved to new wallets from institutional platform FalconX, signaling strong conviction in ETH's long-term value.

Lookonchain's on-chain metrics show sustained whale activity despite recent pullbacks from all-time highs. This divergence between short-term price action and institutional accumulation suggests sophisticated players are positioning for Ethereum's next growth phase.

Market analysts interpret this activity as a bullish indicator, with some projecting ETH could breach $5,000 as institutional adoption accelerates. Ethereum's foundational role in decentralized finance continues to attract capital seeking exposure to blockchain's infrastructure layer.

Institutional Investors and ETFs Now Hold 9.2% of Ethereum Supply

Institutional investors and exchange-traded funds have accumulated 9.2% of Ethereum's circulating supply, signaling deepening adoption by traditional finance. The trend underscores growing confidence in ETH as a strategic asset.

US spot Ethereum ETFs dominate this movement, amassing 5.6% of total supply—worth $31.2 billion—within their first year of trading. Seventy US institutions now hold Ethereum positions, with collective reserves reaching 3.6% of circulation (4.36 million ETH valued at $20.1 billion).

Market analysts identify these institutional accumulations as primary catalysts for Ethereum's 2024 price appreciation. Bitmine Immersion Tech leads corporate holders with $8 billion in ETH acquired since June, followed by SharpLink Gaming's 797,700 ETH position. Both entities' buying waves coincided with major ETH price surges.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH shows potential for movement toward the upper Bollinger Band at $4,856 if it breaks above the 20-day MA resistance at $4,475. The improving MACD momentum and institutional accumulation patterns support a bullish medium-term outlook. However, immediate resistance at the 20-day MA must be overcome for upward momentum to accelerate. BTCC financial analyst James suggests 'The $12,000 price target from strategists appears optimistic but not impossible given institutional adoption trends, though we expect more measured progress toward the $5,000-5,500 range in the coming months.'

| Price Level | Significance | Probability |

|---|---|---|

| $4,093 (Lower Bollinger) | Strong Support | High |

| $4,475 (20-day MA) | Key Resistance | Medium |

| $4,856 (Upper Bollinger) | Near-term Target | Medium |

| $5,000-5,500 | Medium-term Target | Low-Medium |